Find High-Performing Liquidity Pools with Metrix Finance 'Pair' & 'Compare'

Metrix Finance Pro users can now access the 'Pair' & 'Compare' feature, allowing them to find the best-performing pool for a liquidity pair & compare multiple pools against each other.

Metrix Finance has introduce two new solutions for simulating concentrated liquidity pools across leading decentralized exchanges & decentralized finance networks.

Pair enables you to analyze a single pair across multiple exchanges, networks, and fee tiers. A couple use cases are outlined below.

- Jake wants to find the BEST ETH/USDC pool across the Ethereum, Arbitrum, and Optimism networks on Uniswap v3. He can do this using Pair.

- Jake wants to find the BEST ETH/USDC pool across the Ethereum, Arbitrum, and Optimism networks, but also across Uniswap v3 and PancakeSwap v3. He can do this with Pair.

- Jake wants to find other options for ETH/USDC, meaning he also wants to find ETH/USDT, stETH/USDC, etc. Of course, he can do this with Pair.

Compare enables you to analyze multiple pairs and liquidity pools on a single dashboard. A couple use cases are outlined below.

- Jake wants to determine if it's better to deploy into ETH/USDC or WBTC/USDC. He can use Compare to pit these pools against each other.

- Jake wants to save a couple pools so he can later look & compare them against each other. He can use Compare to save and analyze these pools.

These tools are meant to give investors high-confidence when investing in liquidity pools, knowing they are getting the best possible return. Let's dive in and learn how to use these new features on Metrix Finance.

Using the Pair Tool

As previously mentioned, Pair allows you to find the best liquidity pools for a specific DeFi pair. We use the CoinGecko API for tokens & we have whitelisted specific derivatives of tokens (e.g. USDC, USDT, DAI all being derivatives of the USD). If you believe we should add a similar asset to our whitelist, please submit this form.

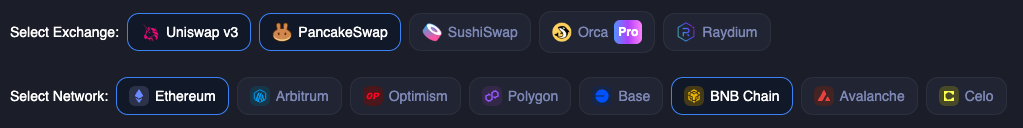

Upon landing on the Pair page, you will be prompted to select your exchanges and networks, similar to how you select exchanges and networks on the Discover page. In this example we will be using Uniswap v3 & PancakeSwap on the Ethereum & BNB Chain.

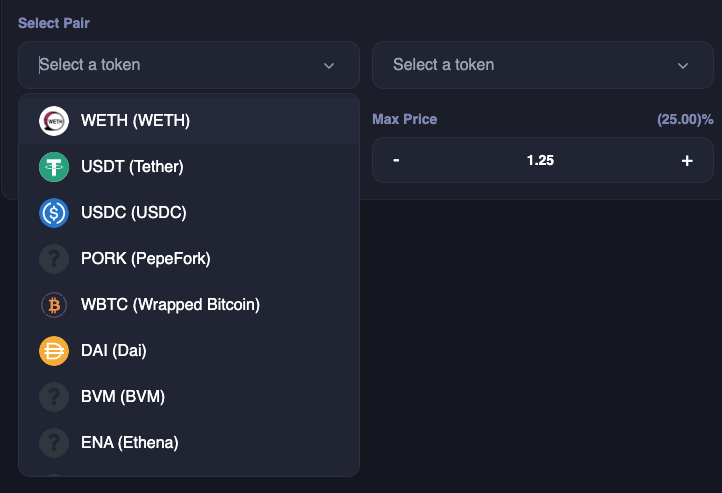

Moving on, it is time to select your pair. A dropdown will appear with a list of tokens provided by CoinGecko API. It will only show tokens specific to the networks that you are using. In this example we are going to select ETH & USDC.

Now it's time to input some information to show tailored results. Adjust your deposit amount to how much capital you plan on deploying into the liquidity pool. Calculation range is how many days you wish to be factored into the simulating (30 days factors in 30 days of fees & volume). While we do not recommend it, you can adjust the current price if you wish. What you should pay most attention to is the 'Min Price' and 'Max Price' sections. This is where you will enter the range for your liquidity position.

Lastly, if need be, you can toggle the pair by select the blue arrows, toggle the full range switch to provide liquidity on every price point, and decide whether you want to showcase similar liquidity pools. By enabling 'Similar Assets' we will showcase assets that share the same price of the initial asset. This includes derivatives, pegged-assets, stablecoins, and more. For example, select ETH as the main asset will show stETH as a similar asset because they share the same price & stETH is a derivative of ETH. You can submit similar assets using this URL.

In this example we will be using a deposit amount of $10,000, calculation range of 30 days, the default current price & range, as well as toggling similar assets.

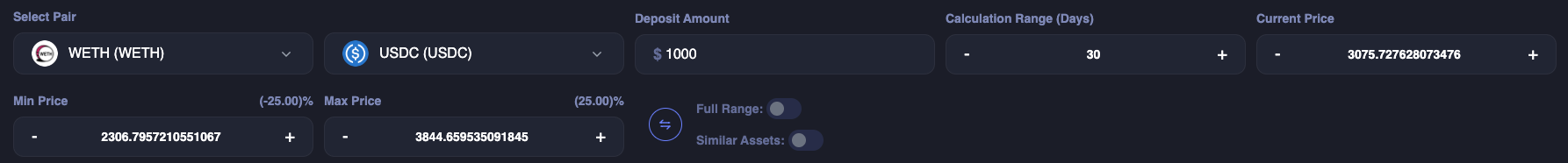

I am now greeted with multiple options for the ETH/USDC pool, including ETH/USDT on Uniswap & PancakeSwap, but also on the Ethereum network & BNB network. It is now super easy to find the BEST possible return for the ETH/USDC pair & similar assets.

Using the Compare Tool

The compare tool allows you to see some at-a-glance information for a concentrated liquidity pool. Additionally it allows you to view multiple pools on the same page to help determine which one you should deploy capital into.

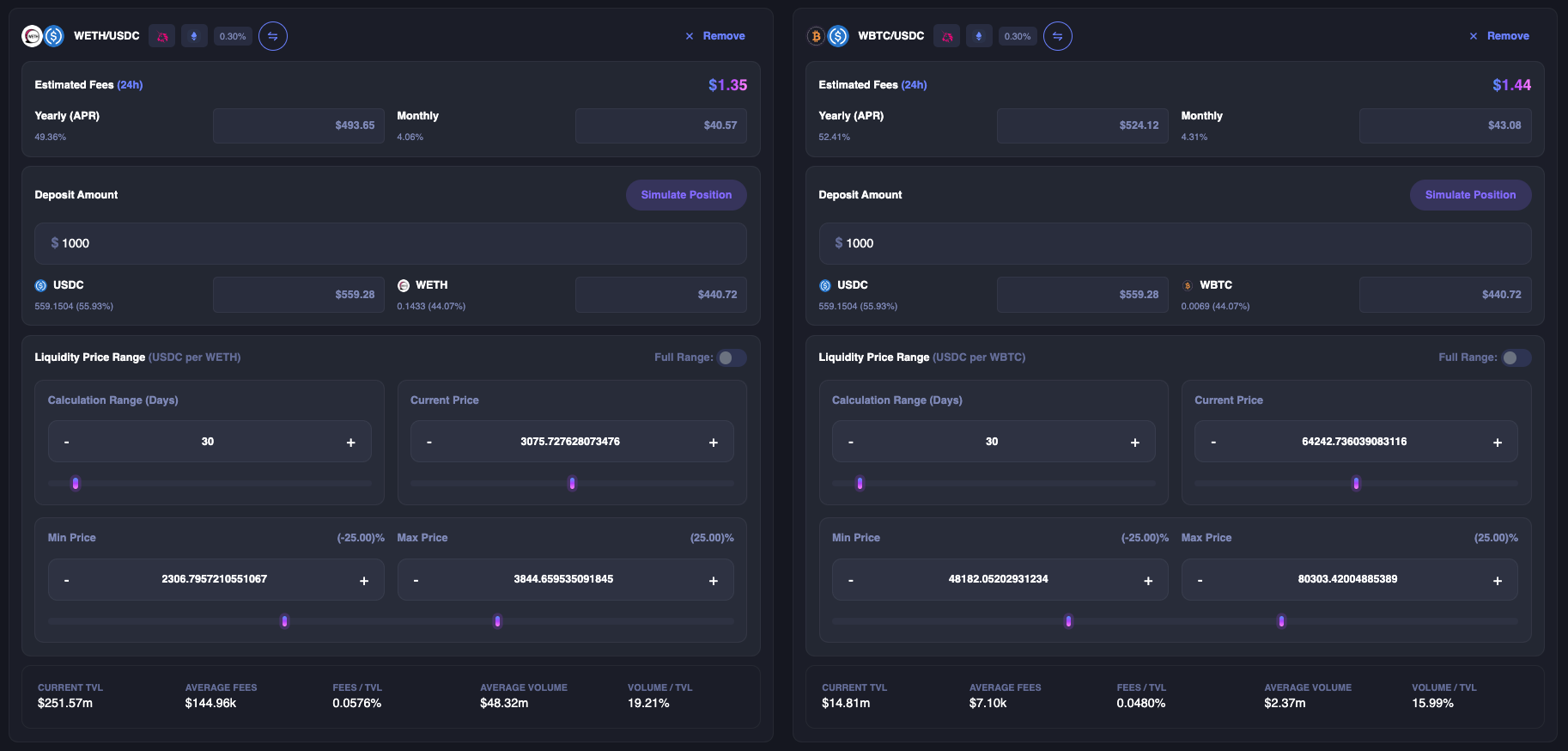

After landing on the Compare page, you'll be prompted to add a simulation to the compare section. The process is very similar to how you simulate a pair on the Simulate page. For this example, we will add ETH/USDC & WBTC/USDC to our compare page.

After adding a liquidity pool to the Compare page, you will be able to adjust the Deposit Amount, Calculation Range, Current Price, Min Price, and Max Price. If we wish, we can also toggle between full range & concentrated liquidity. In the above screenshot, we used ETH/USDC and WBTC/USDC with the default parameters. As you can see, the WBTC/USDC pool performs slightly better than the ETH/USDC pool as it has a higher APR.

Hope you Enjoy!

Currently Compare & Pair are only available to Metrix Pro users. We use revenue from Metrix Pro to continue to build out new features and support new exchanges. Follow our X page to stay up-to-date.

Remember, we're always adding new benefits to Metrix Finance and we recommend you join our Discord so you can play a role in helping us shape the future of liquidity provision. Here you can explore other users LP strategies & suggest features.